What is GST (Goods and Services Tax)? GST Rates, Benefits of GST, Latest GST News and Updates

GST: GST stands for Goods and Service Tax which was launched in the year 2017. GST is applicable for sale of goods and services and You know the details about GST Rates, GST Impact, GST Council, GST Analysis, GST News on Fresherslive. Taxes that were collected under various categories are tagged under a single common tax name GST. Types of GST, GST Bill, GST Calculation, and details relating to GST are given in the article.

Updated: Jun 09, 2020 17:40 IST

What is GST?

GST or Goods and Services Tax is the value-added tax levied upon the goods and services sold for domestic consumption. The tax charged at every stage of the production process is refunded to all parties in the production chain except the end customer/consumer.

The single GST replaced several taxes and levies which included:

central excise duty

services tax

additional customs duty

surcharges

state-level value-added tax

Octroi

GST was implemented by Prime Minister Narendra Modi in 2017. The main objective of GST is to find a way to the common national market. This will in turn increase competition in India as well as globally for the Indian goods and services.

What are the types of GST?

GST has brought a reform in the taxation in India. Various types of indirect taxes replaced by GST is categorized under four categories. The four types are:

CGST - CGST is a Central Goods and services tax. It is applicable to suppliers dealing within the state. Taxes that are collected will be shared with the central authority body.

SGST - SGST is a state Goods and services tax. It is applicable to suppliers who dealing within the state. Taxes that are collected will be shared with the state authority body.

IGST - IGST stands for an Integrated Goods and services tax. It is applicable to suppliers who dealing with interstate business and import transactions. Taxes which are collected will be shared to central and state authority body.

UTGST - If the transaction is related to any union territory.

What is the difference between different types of GST?

|

GST Types |

Authority Benefitted |

Priority of Tax Credit use |

Collected by |

Applicable (Goods & Services) Transaction |

|

CGST |

Central Government |

CGST IGST |

Central Government |

Within a single state (intrastate) |

|

SGST |

State Government |

SGST IGST |

State Government |

Within a single state (intrastate) |

|

IGST |

Central and State Government |

IGST CGST SGST |

Central Government |

Between two different states or a state and a UT (interstate) |

|

UTGST/UGST |

Union Territory Government |

UTGST IGST |

UT Government |

Within a single Union Territory |

What is GST Rate?

GST imposed different slabs of GST Rates for various products. The rate of GST is 18% for soaps and 28% on washing detergents. GST on movie tickets is based on slabs, with 18% GST for tickets that cost less than Rs. 100 and 28% GST on tickets costing more than Rs.100 and 5% on readymade clothes. The rate on under-construction property booking is 12%. Most of the products and services fall under the category of GST. In some types of foods, GST is not applicable namely fish, honey, milk, eggs, meat, curd, buttermilk, fruits, sindoor, bindi, newspapers, handlooms, salt, besan, etc.

What is an e-Way Bill?

An e-Way Bill is an electronic permit for shipping goods similar to a waybill. It was made mandatory for inter-state transport of goods from 1st June 2018. It is required to be generated for every inter-state movement of goods beyond 10 Km (6.2 mi) and the threshold limit of 50,000. A unique e-Way Bill Number (EBN) is generated either by the supplier, recipient, or the transporter.

What are GST Tax Slabs?

Goods and Services Tax is divided into five tax slabs. They are 0%, 5%, 12%,18% and 28%. GST is exempted from Alcohol for human consumption and Petrol and petroleum products (GST will apply at a later date) i.e. Petroleum crude, High-speed diesel, Motor Spirit (petrol), Natural gas, Aviation turbine fuel. There is a special rate of 0.25% on rough precious and semi-precious stones and 3% on gold. 28% GST applies on a few items like aerated drinks, luxury cars, and tobacco products.

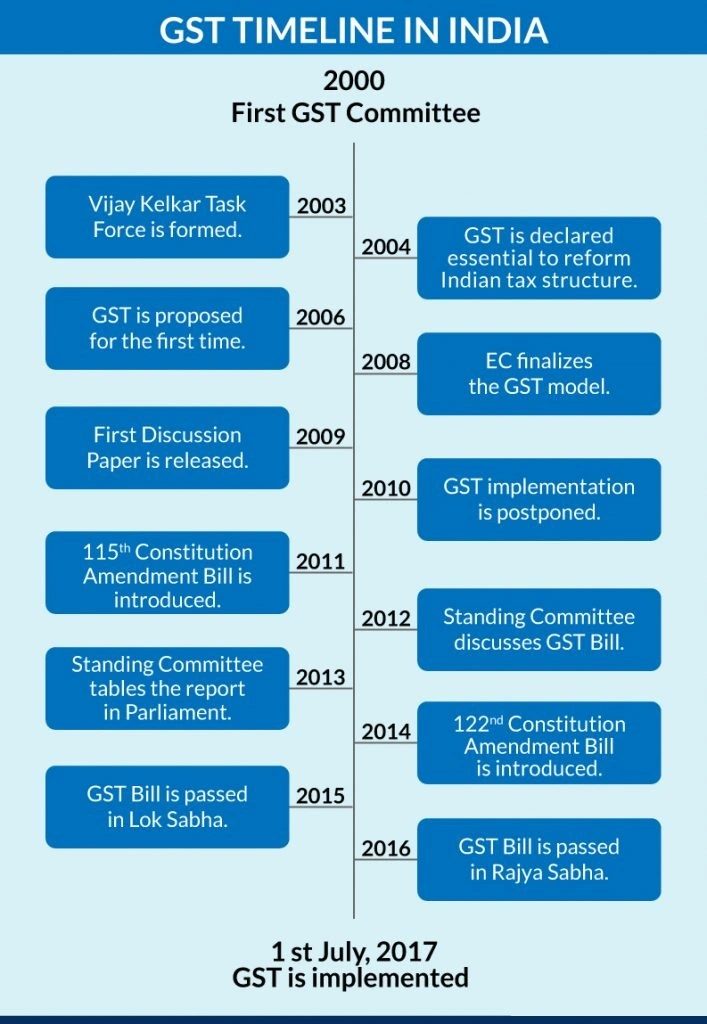

History of GST in India:

India's biggest tax reform in the 70 years of independence is the implementation of GST (Goods and Services Tax). The implementation of GST will help to modernize India as Asia's third-largest economy. The world’s first country to implemented GST is France, in the year 1954. More than 160 countries have established the GST system.

The history of GST in India dates back to the year 2000. Finally, in 2017, GST was implemented with four bills relating to it becoming an Act. The main objective of the GST Act is to streamline taxes for goods & services across India.

Let us see the timeline of GST:

2000: GST was first suggested by the Atal Bihari Vajpayee Government in 2000. An Empowered Committee (EC) headed by Asim Dasgupta was constituted to create a structure for GST, based on their experience in designing State VAT.

2004: Vijay L. Kelkar, advisor to the finance ministry, led task force indicated that the existing tax structure had many issues that would be mitigated by the GST system.

February 2005: In 2005, Finance minister, P. Chidambaram, announced that the GoI is to implement a uniform GST structure across the country in the budget session for the financial year 2005-06.

February 2006: P. Chidambaram announced that GST will be introduced set 1 April 2010. In November, Parthasarthy Shome, the advisor to P. Chidambaram, suggested that states/UTs should start to prepare and make reforms for the upcoming GST regime.

February 2007: GST implementation date was set as 1 April 2010 in the union budget for 2007-08.

February 2008: Finance minister confirmed the preparation of the roadmap for GST and the implementation was confirmed to be 1 April 2010.

July 2009: Pranab Mukherjee, the new finance minister of India, announced the basic design of the GST system and reaffirmed 1st April 2010 as a deadline. Also in November, the EC headed by Asim Dasgupta tabled the First Discussion Paper (FDP), describing the proposed GST regime.

February 2010: GoI launched the mission-mode project that laid the foundation for GST. This project, with a budgetary outlay of Rs.1,133 crore, computerized commercial taxes in states. GST implementation was postponed.

March 2011: INC lead government introduced 115th Amendment Bill for the introduction of GST. The Bill was sent to a standing committee for a detailed examination after the protest by the opposition parties.

June 2012: The standing committee discussed the Bill over the 279B clause. It offers additional powers to the Centre over the GST dispute authority. A deadline for resolution of issues was set as 31 December 2012.

February 2013: The Finance minister announced that the Centre will provide Rs.9,000 crore as compensation to states upon the implementation of the indirect tax reform. In August the standing committee submitted the report to the parliament. The panel approved the regulation with few amendments.

May 2014: The Constitution (122nd Amendment) Bill introduced and was lapsed. In 2014, PM Narendra Modi was voted into power at the Centre. Finance minister, Arun Jaitley, submitted the Constitution (122nd Amendment) Bill, 2014 in the parliament.

May 2015: Lok Sabha, the Lower House, passed the Constitution Amendment Bill. GoI also announced that petroleum would be kept out of the ambit of GST for the time being.

March 2016: It was agreed that the GST rate not to be set above 18%. But he is not inclined to fix the rate at 18%. The fixed rate of tax was ruled out.

June 2016: Ministry of Finance released the draft model law on GST to the public, expecting suggestions and views.

August 2016: GST Bill was passed by Rajya Sabha, the Upper House. The government’s proposal on the four broad amendments to the GST Bill was finally approved.

September 2016: President of India gave his consent for the Constitution Amendment Bill to become an Act.

2017: Four Bills related to GST became Act after President Ram Nath Kovind's assent. The 4 Bills are:

Central GST Bill

Integrated GST Bill

Union Territory GST Bill

GST (Compensation to States) Bill

The GST Council finalized the GST rates and rules. GoI declared the implementation of the GST Bill from 1 July 2017.

GST - FAQ

Any Indian citizen who has an aggregate turnover of more than Rs.20 lakh is liable to register under GST. With this limit, he/she needs to pay the tax also. However, people from the northeastern state should register if your turnover is more than Rs.10 lakh.